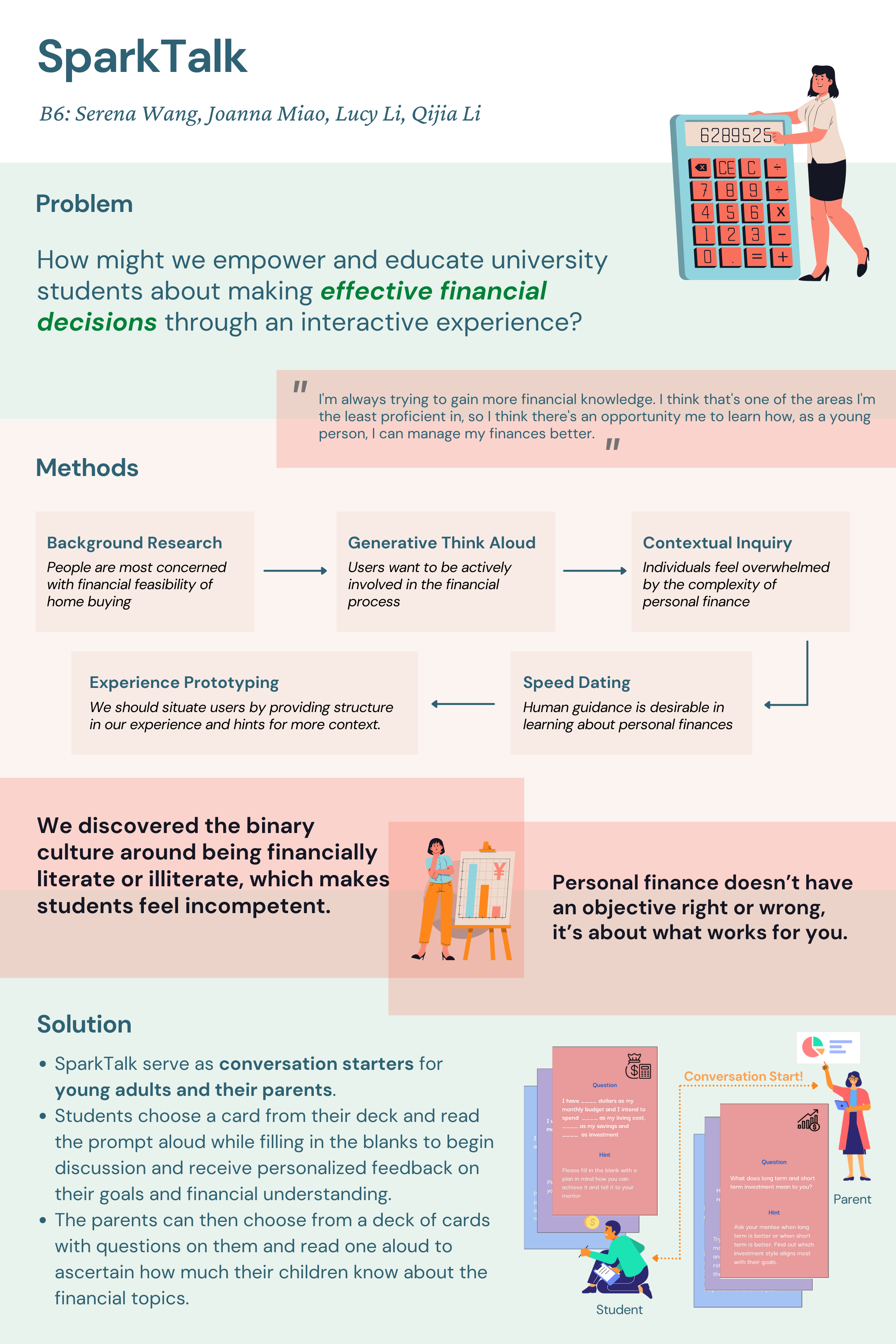

User-Centered Research

Team: Meixuan Li, Serena Wang, Joanna Miao, Qijia Li

My Role: Project Manager, User Researcher

Project Plan

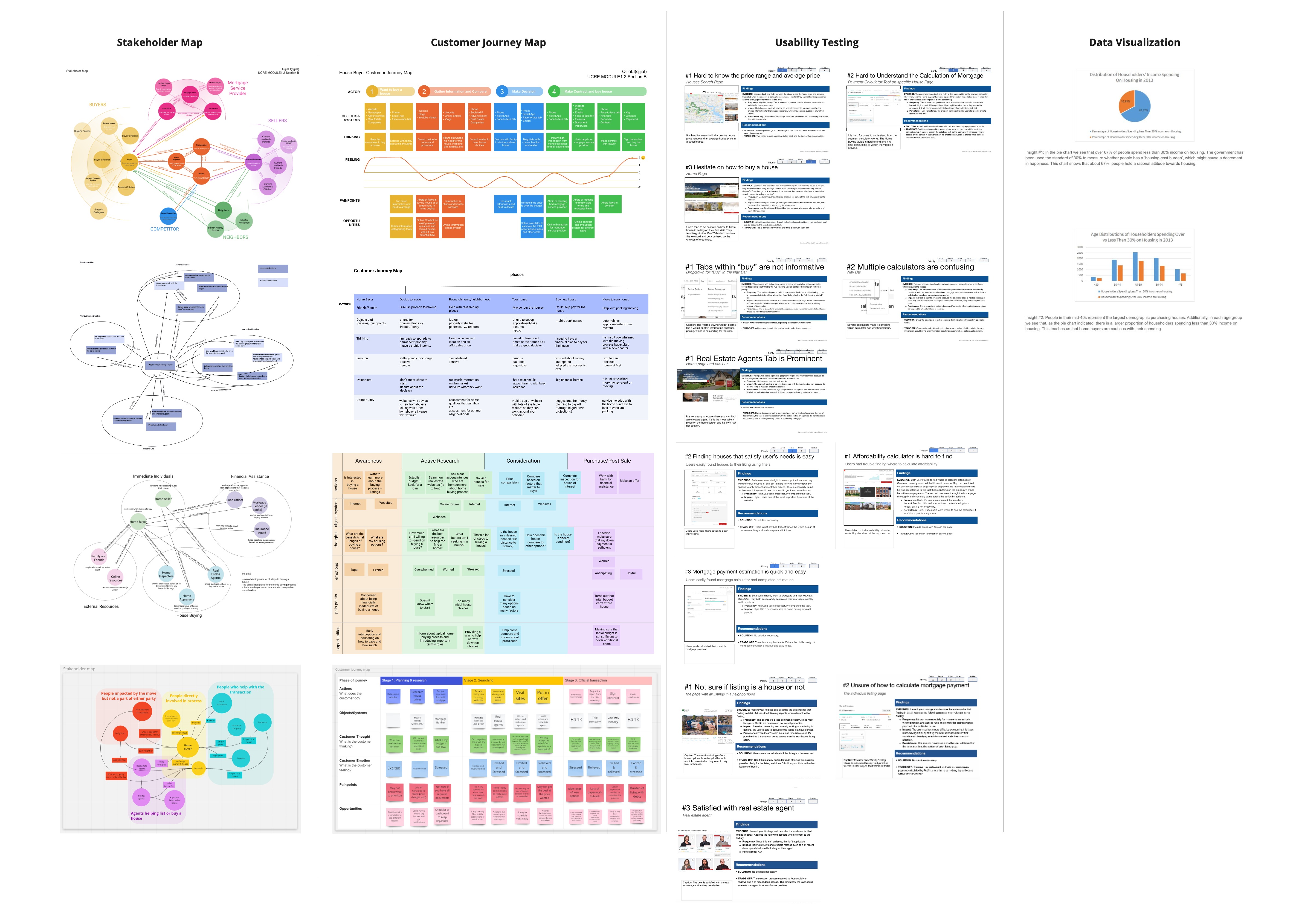

Background Research

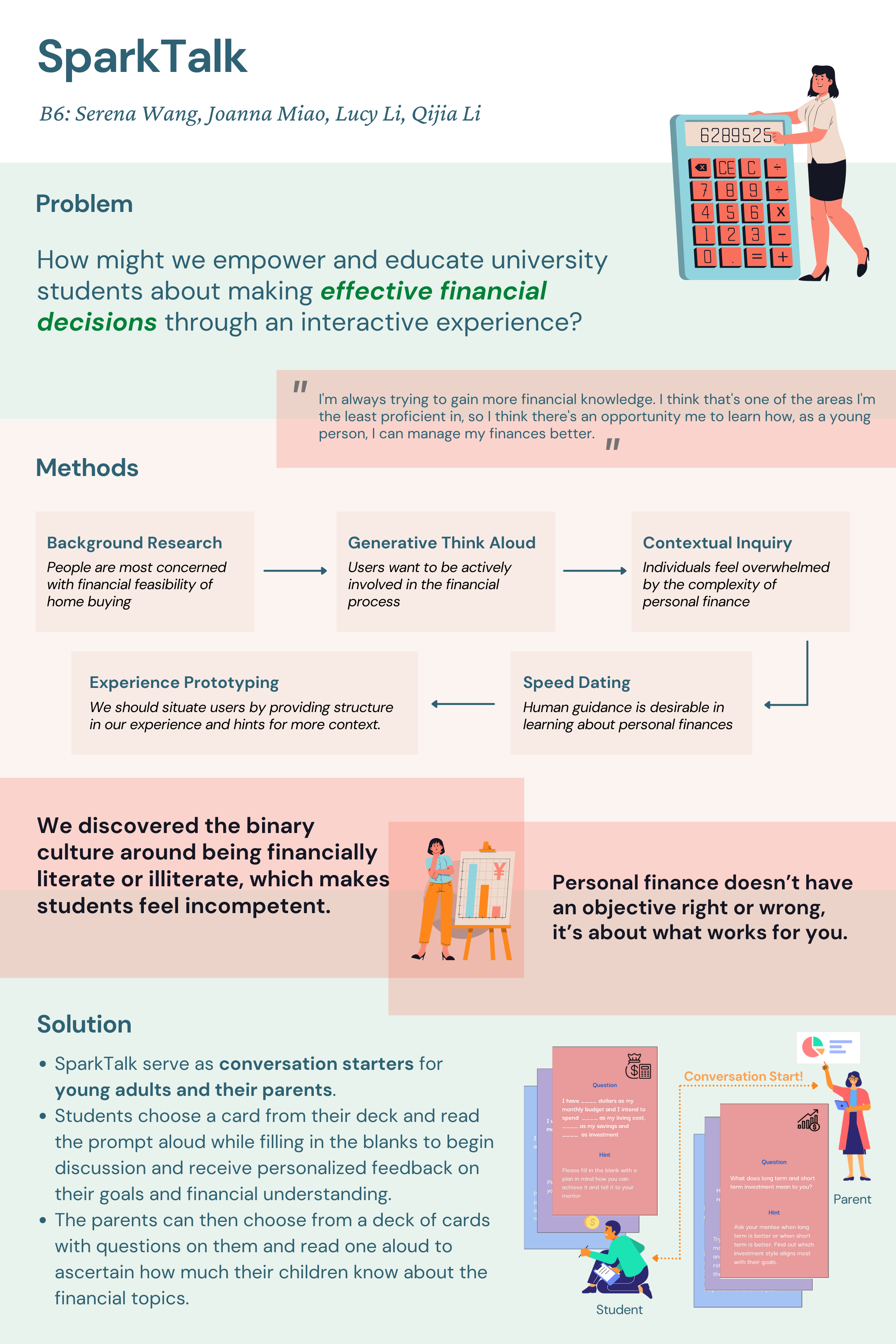

We made stakeholder and journey maps to understand the house-buying process. Then, we explored a breadth of house buying related resources through experiential research and informational research.

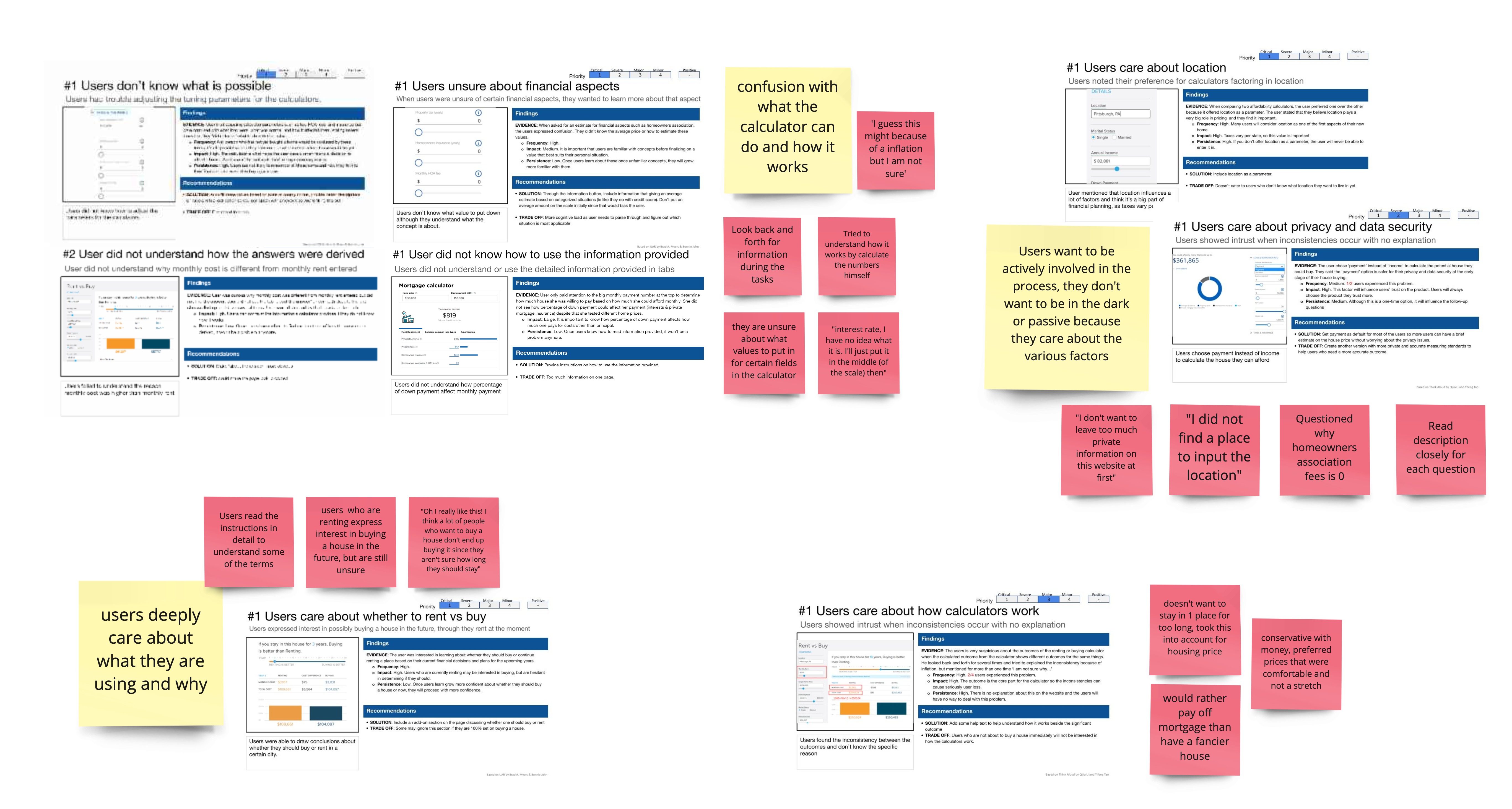

Think-Aloud for Generative Research

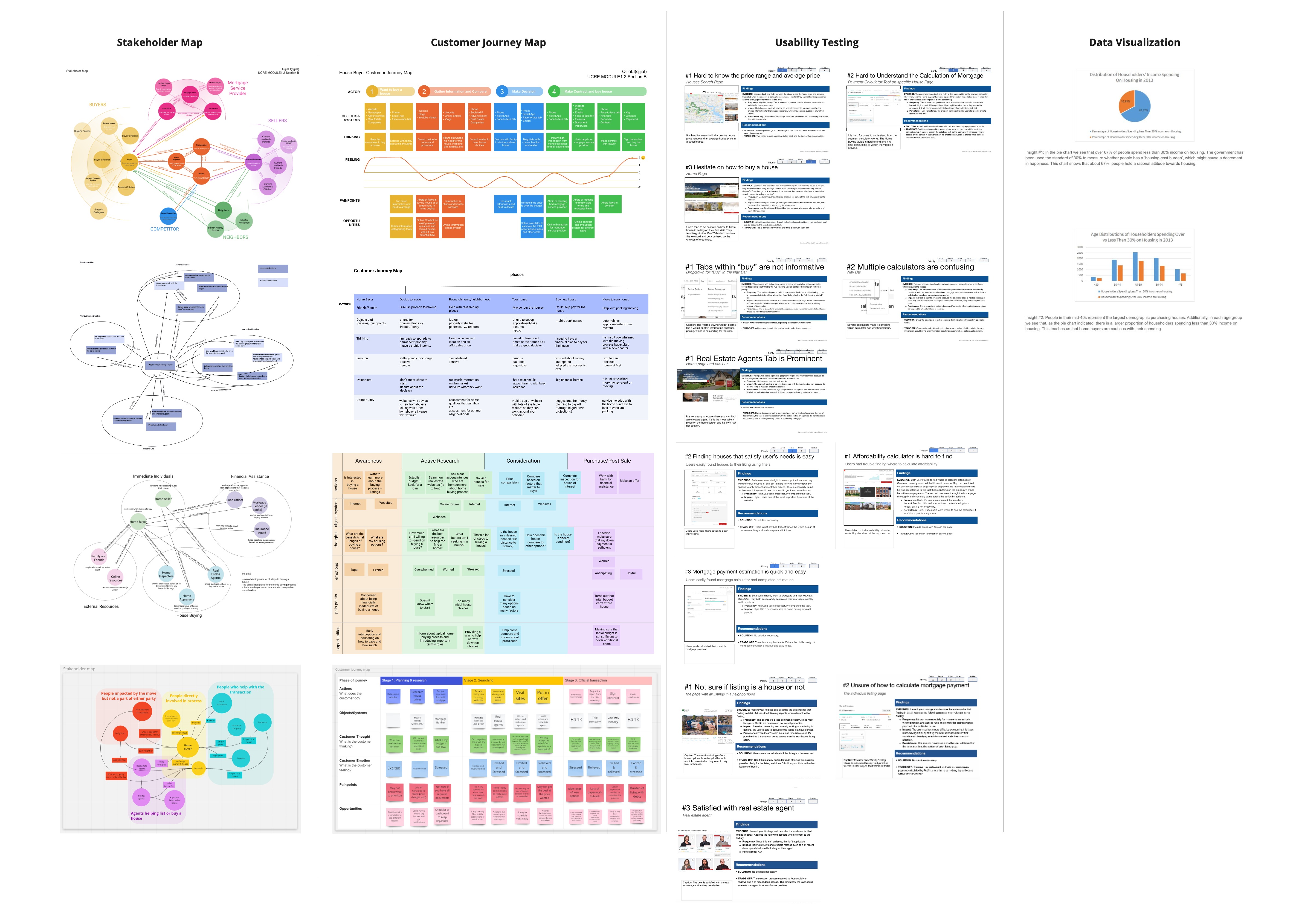

We conducted four generative competitive think-aloud studies on financial aspects of house buying. We used existing technology that help users make financially-sound decisions to learn about users and had each participant follow a series of tasks that engaged them in different aspects to analyze house buying decisions financially.

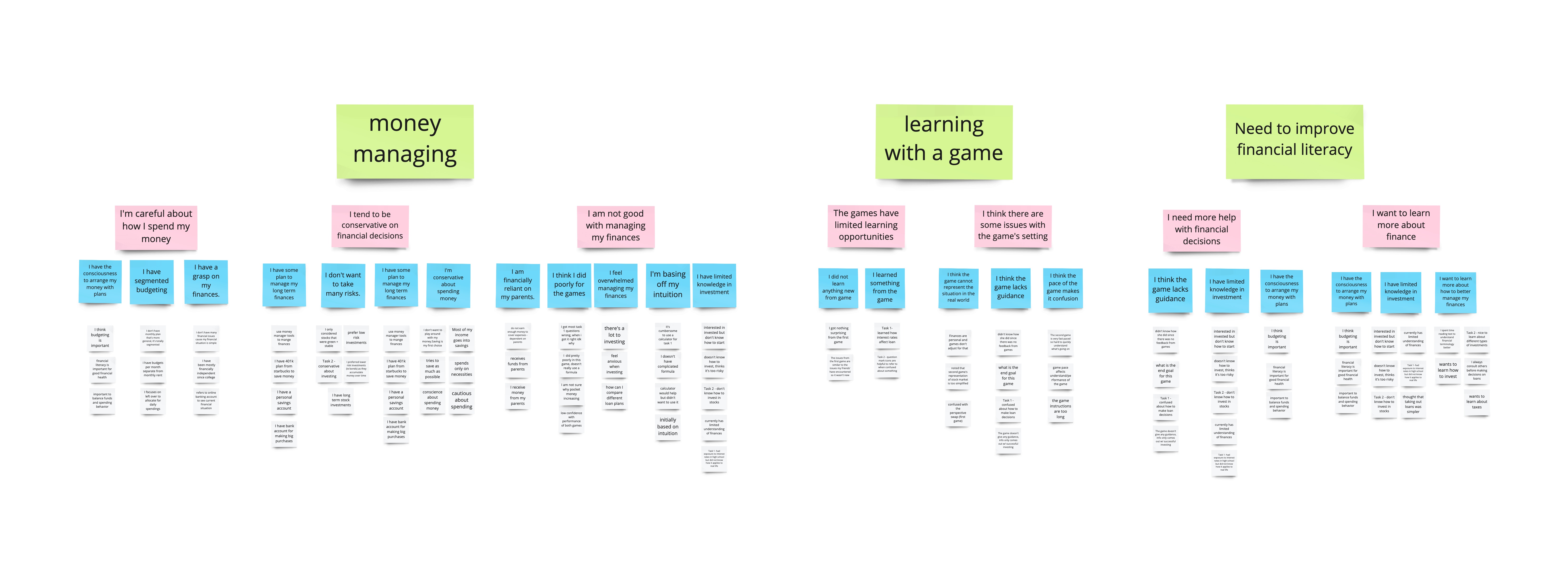

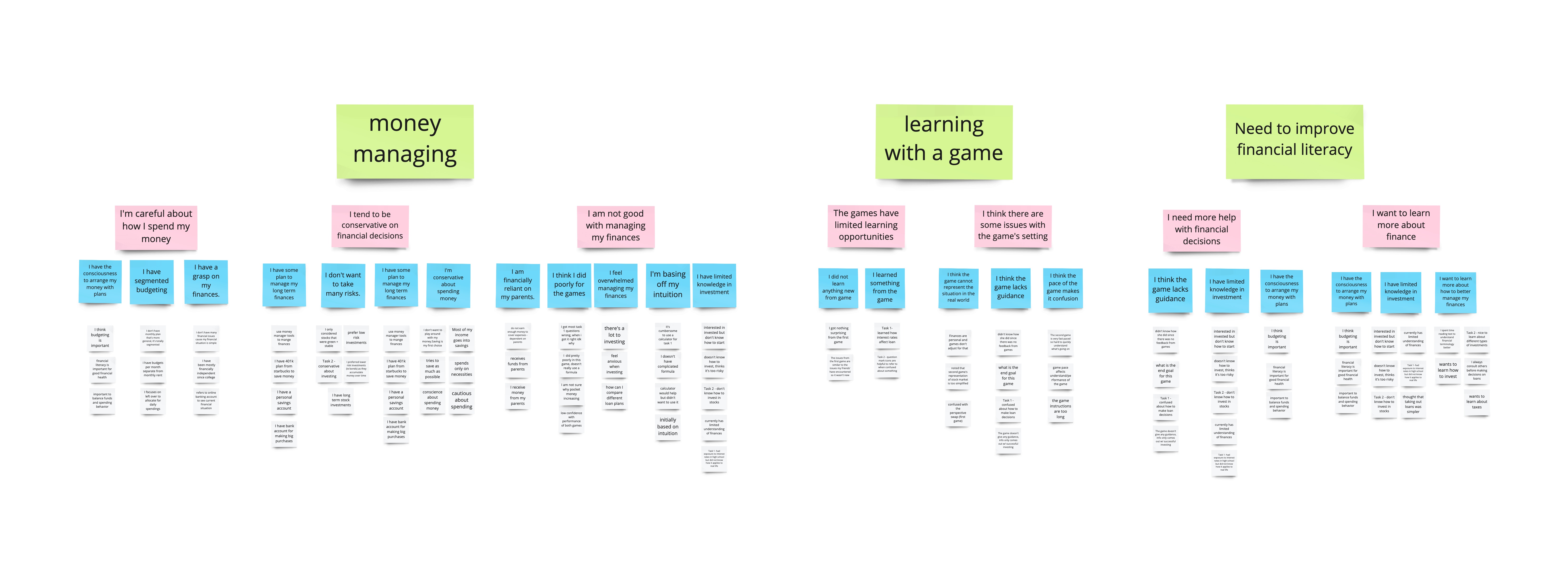

Contextual Inquiry

Because the practical tools seemed too vigorous for college students, we thought games could be a good alternative. Hence, we decided to use contextual inquiry to see how participants do in financial games. We conducted interpretation sessions for each interview and used the notes for affinity diagramming, which led to new insights.

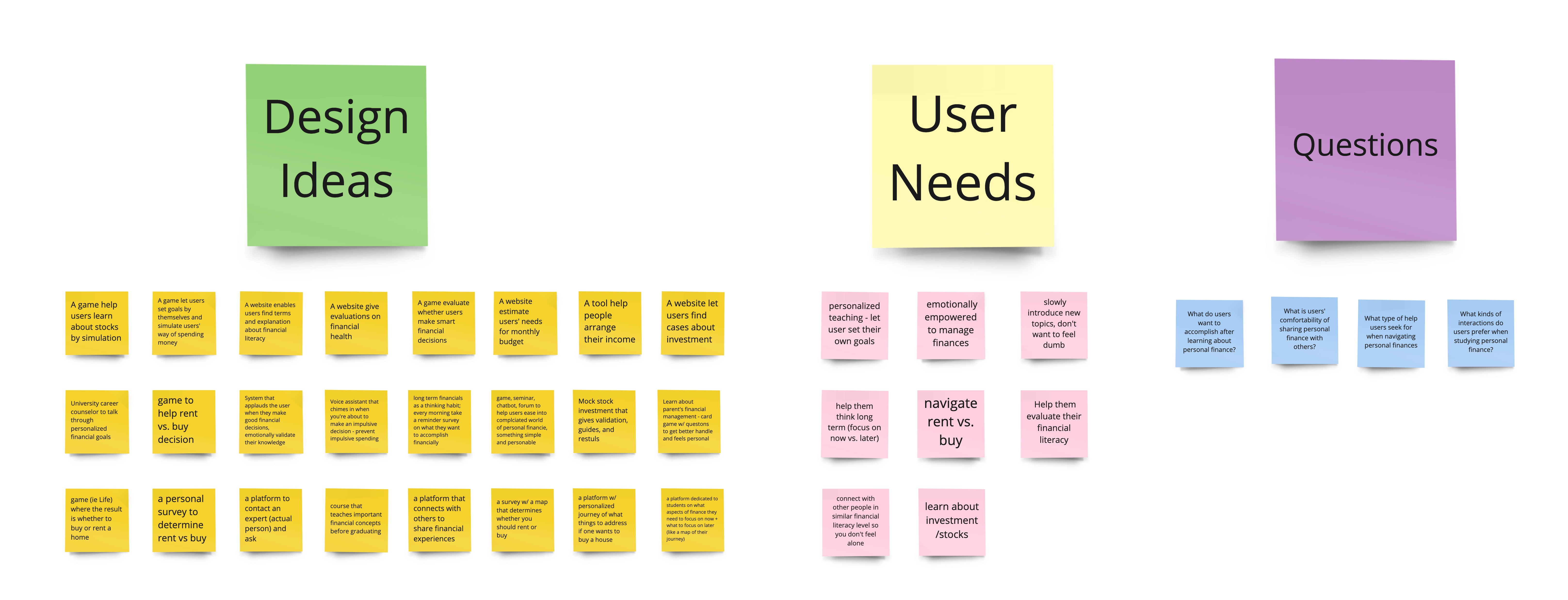

Speed Dating

We walked the wall by first gathering and reflecting on our research and insights from our affinity diagram and past deliverables. We then used stickers to consolidate and group our insights to display the design ideas, user needs and the questions we identified during the walk the wall. This ultimately allowed us to better understand our problem space, the needs of our target users, and areas of opportunity.

.jpg)

We each generated 8 possible solution scenarios to different needs, and posted them on our Miro board. We then labeled the needs we addressed and voted on them with stars as a team.

.jpg)

We each selected one user need for which we created a set of storyboards. Then, we conducted speed dating sessions to get feedback from users on how accurately each storyboard represented the user needs as well as the effectiveness of the proposed solutions.

.jpg)

Experience Prototyping

In prototype testing, the mentor and mentee each received a different deck of virtual cards with open-ended or fill-in-the-blank questions as conversation starters. They took turns picking a card and reading it aloud to begin discussions on different topics of personal finance.

.png)

Final Thoughts:

My team in this project was one of the best teams I have ever worked with. We worked closely together on every part of the project, so we were all on the same page. The work was evenly distributed and everyone was happy to take

on any extra work when necessary. We all took full responsibility for our own parts. I knew I got super lucky with this team and this seamless collaboration was one of a kind.